Principal 401k withdrawal calculator

1 IRS annual limits for 2022. Hopefully you have more than this saved for.

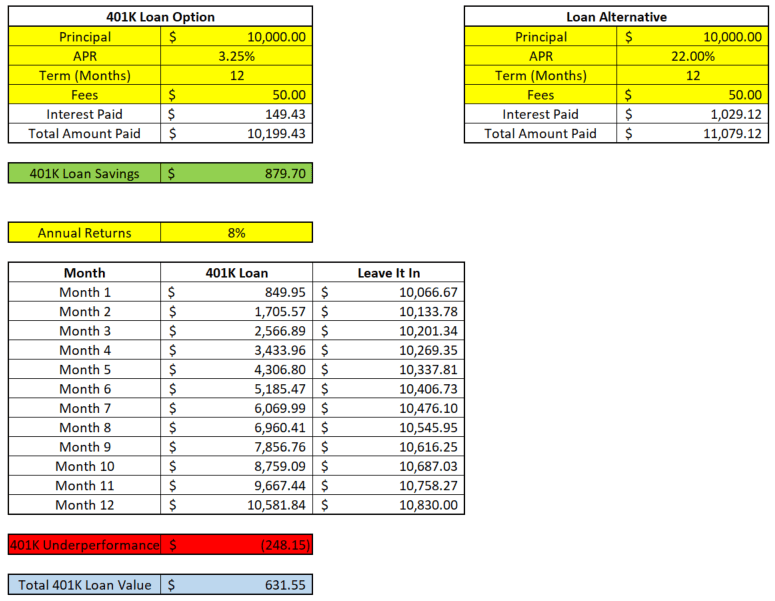

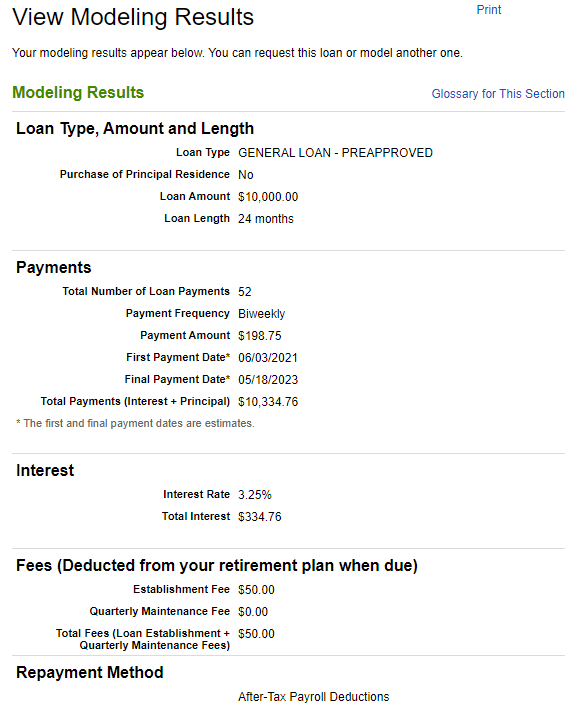

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

36 Principal 401k withdrawal calculator Kamis 01 September 2022 Calculate your potential income from the deferred comp plan.

. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. It can fill the gap between income earned. Use this calculator to estimate how much in taxes you could owe if.

Now weve reached the point of dipping into your 401 kstopping short of a complete withdrawal. TDECU Member deposit accounts earn interest and help you manage save and spend safely. Using this 401k early withdrawal calculator is easy.

Make a Thoughtful Decision For Your Retirement. And from then on. It is the simplest most straightforward of all possible models by emulating.

You will find the savings withdrawal calculator to be very flexible. Use the forms below to request a distribution or redemption from your Principal Traditional IRA Roth IRA SIMPLE IRA SEP IRA or 403b7 accountSubmit completed forms. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

The Early Withdrawal Calculator the tool. 25Years until you retire age 40 to age 65. If your 401 k balance is composed of equal parts employee and employer funds you are only entitled to 30 of the 12500 your employer contributed or 3750.

Log in to see your. To give you an idea 20000 in a 401 k 403 b or 457 b account could triple in 20 years at an average 7 rate of returnbut not if you withdraw it today. Individuals will have to pay income.

Nonqualified Deferred Compensation Planner. According to research from Transamerica this is the median age at which Americans retire. While it is most frequently used to calculate how long an investment will last assuming some.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. The Retirement Wellness Planner information and Retirement Wellness Score are limited only to the inputs and other financial assumptions and is not intended to be a financial plan or.

On the surface it may seem to make sense to rid yourself of 15 or 16. For these reasons this retirement withdrawal calculator models a simple amortization of retirement assets. Quickly see whether youre on track with your retirement goals and see which small changes could add up to a potentially big impact.

Ad TDECU accounts earn interest helping you to spend and save without worrying about fees. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

Ad Estimate The Impact Of Taking An Early Withdrawal From Your Retirement Account. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA. Current 401 k Balance.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. Thats why one common strategy is to use a deferred comp plan as a bridge in retirement income.

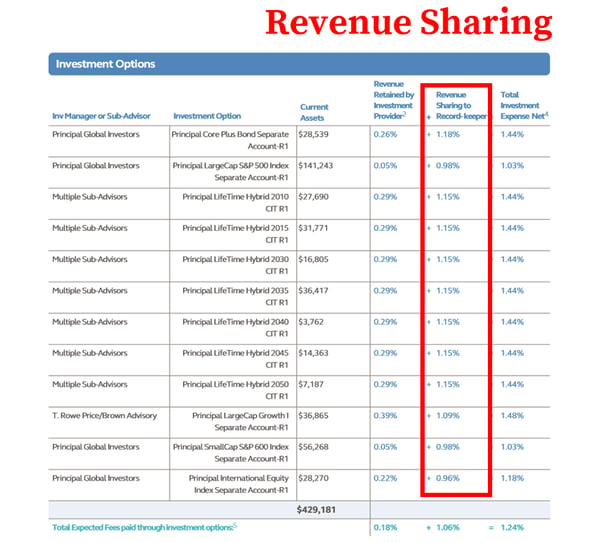

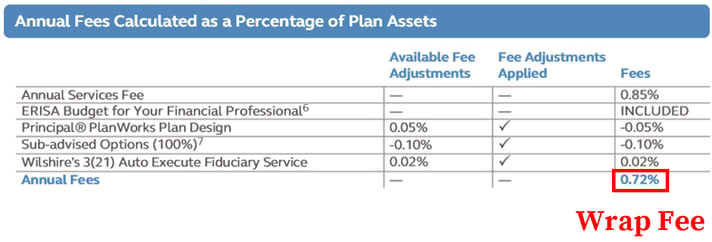

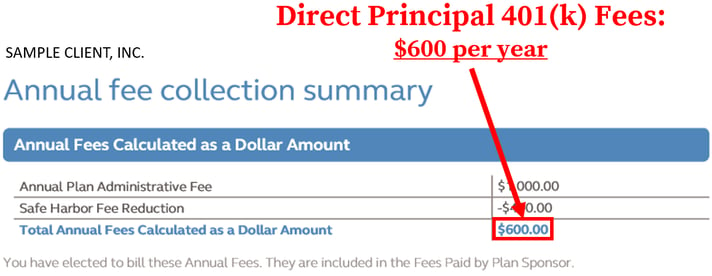

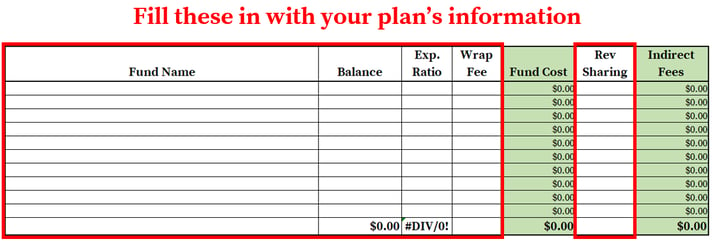

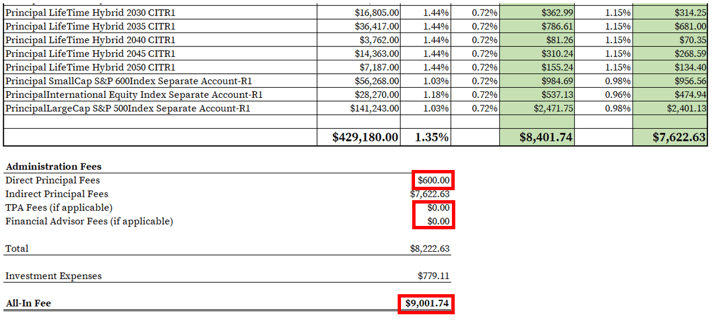

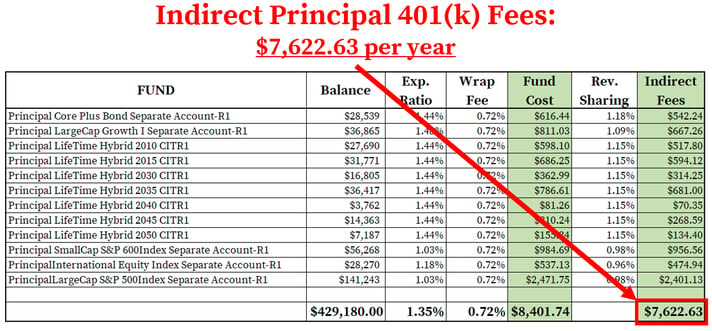

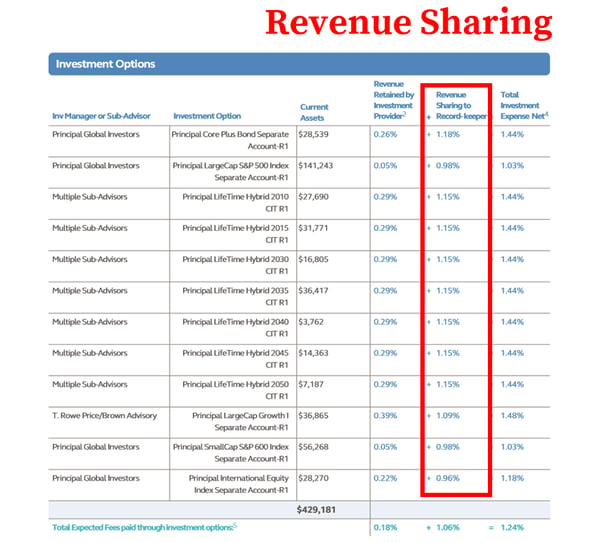

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

Introducing Simply Retirement By Principal Ubiquity

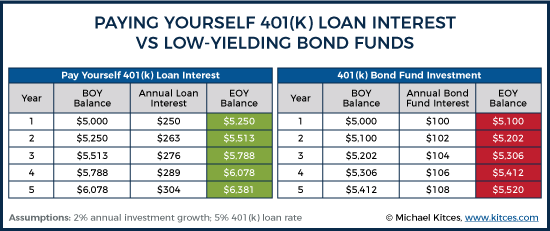

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

Retirement Income Creating Your Own Paycheck Principal

How To Find Calculate Principal 401 K Fees

Bond Price Finance Apps Tax App Financial Calculator

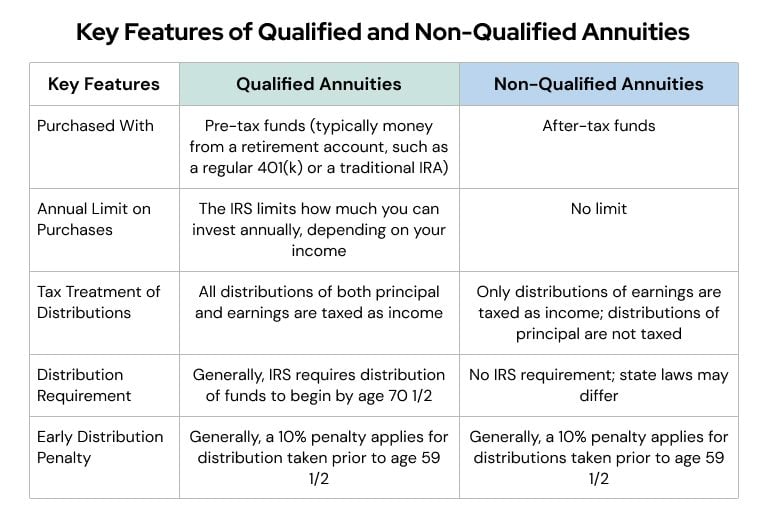

Qualified Vs Non Qualified Annuities Taxes Distribution

How To Find Calculate Principal 401 K Fees

Making A Choice For Your 401 K Principal

:max_bytes(150000):strip_icc():gifv()/Principal_edit-7384a3492a48477e81cd002d2bc4b0ba.jpg)

Principal Life Insurance Review 2022

Catch Up Contributions How Do They Work Principal

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You